USD Price Action Setups: EUR/USD, GBP/USD, USD/JPY, Gold

- Alex

- Jan 21

- 3 min read

As 2025 began, the US dollar entered the year with strong momentum, supported by the US exceptionalism narrative and expectations of continued USD outperformance. EUR/USD was widely expected to push toward parity, and bullish USD positioning was crowded. However, less than two weeks into the new year, both DXY and EUR/USD marked key inflection points that would go on to define much of the year’s price action.

Since then, the broader USD complex has transitioned into a prolonged phase of consolidation and range trading. Recent political developments have once again shaken that balance, triggering renewed USD selling and a sharp rally in EUR/USD. While short-term volatility has picked up, the broader picture still reflects markets searching for clearer directional conviction.

US Dollar Outlook

The US dollar has spent much of the past year oscillating between well-defined support and resistance zones. Political pressure from President Trump has repeatedly surfaced, with ongoing efforts to talk the currency lower forming a recurring theme during the early stages of his second term.

While similar rhetoric last year contributed to USD weakness, those moves were ultimately reversed when tariff threats were softened and risk appetite improved. Since the second half of last year, the dollar has remained largely range-bound, mirroring the sideways behaviour seen in EUR/USD.

The latest USD sell-off follows renewed tariff threats toward Europe. While the move has been decisive in the short term, chasing weakness at current levels remains challenging, with price now approaching prior support zones that may slow downside momentum.

XAU/USD Weekly Chart

EUR/USD Outlook

EUR/USD has responded strongly to the latest USD weakness, breaking higher after successfully defending key support earlier in the year. That defence marked the base for an ascending structure that ultimately resolved higher, reinforcing the broader recovery from early-2025 lows.

Near-term momentum has clearly shifted in favour of euro bulls, although overbought conditions caution against chasing strength. From a structural perspective, the pair remains constructive, but sustained upside will likely require follow-through beyond the current resistance zone to transition from recovery into trend continuation.

EUR/USD 4-Hour Chart

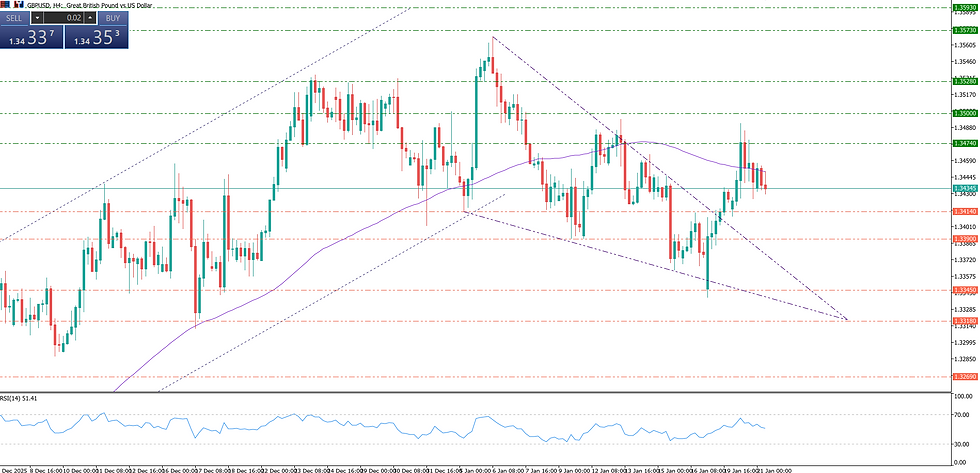

GBP/USD Outlook

GBP/USD continues to present one of the cleaner expressions of USD weakness. Unlike EUR/USD, which has been heavily influenced by political headlines, sterling has maintained a more technically driven bullish structure.

A falling wedge formation that developed earlier has now resolved higher, with price holding above former resistance turned support. This keeps the medium-term outlook constructive, with higher-low formations supporting the broader bullish bias. Relative to other USD pairs, GBP/USD remains better positioned for trend continuation rather than short-term mean reversion.

GBP/USD 4-Hour Chart

USD/JPY Outlook

Despite broad USD selling pressure elsewhere, USD/JPY has remained relatively resilient. This highlights the persistent weakness in the Japanese yen, which continues to underperform across multiple crosses.

USD/JPY remains the preferred venue for expressing USD strength. While the 160.00 level continues to act as a psychological barrier, price has struggled to pull back into deeper support zones, suggesting the underlying bid remains intact. As long as higher support levels continue to hold, pullbacks may remain corrective rather than trend-reversing.

USD/JPY 4-Hour Chart

Gold Outlook

While many currency pairs have spent the past year oscillating within ranges, gold has remained notably decisive. The broader bullish trend has persisted through multiple macro cycles, reinforcing gold as one of the clearest directional markets heading into 2026.

The primary challenge for gold bulls is timing rather than direction. Upside breakouts have become increasingly difficult to chase, while pullbacks to support have consistently attracted renewed demand. Recent price action fits this pattern, with gold retesting key support before breaking out to fresh all-time highs.

Patience remains essential, but as long as pullbacks continue to hold above structural support, the broader gold outlook remains firmly constructive.

XAU/USD 4-Hour Chart

Bottom Line

The US dollar remains stuck between political pressure and technical range dynamics, creating mixed opportunities across major pairs. EUR/USD and GBP/USD favour selective USD weakness strategies, while USD/JPY continues to stand out for relative USD strength. Gold remains the most structurally consistent market, with its long-term bullish trend intact despite short-term positioning challenges.

Directional conviction will likely depend on whether recent political catalysts evolve into sustained policy action or fade into another period of consolidation.

Comments