US Dollar Analysis: DXY Rebounds Ahead of Key NFP Test

- Alex

- Jan 9

- 3 min read

The US Dollar Index has extended its recovery, posting three consecutive sessions of gains and rising more than 0.6% in the short term. This rebound is largely driven by positioning ahead of the US Nonfarm Payrolls release, with markets increasingly leaning toward a resilient labour market outcome. So far, anticipation around the data has been enough to support dollar demand, and a firm employment report could allow bullish momentum to extend further in the days ahead.

NFP in Focus

Friday’s January 9 Nonfarm Payrolls report is the main event for markets. Consensus expectations point to job creation of around 60,000 in December, slightly below the previous 64,000 reading. While growth is expected to moderate, forecasts do not yet signal a meaningful deterioration in labour market conditions.

More importantly, the data carries implications for the Federal Reserve’s early 2026 policy outlook. Market pricing continues to reflect a strong bias toward policy stability. For the January 28 meeting, the probability of rates remaining unchanged at 3.75% sits near 90%. Looking further ahead, expectations for the March 18 meeting show a notable shift, with the probability of a neutral rate stance rising to 58.94%, up from 48.18% in early December. This adjustment suggests markets see limited justification for early rate cuts, assuming employment remains broadly stable.

Yields Stabilise, Supporting the Dollar

These evolving expectations have helped stabilise US Treasury yields. The 10 year yield has rebounded toward the 4.2% area, close to levels seen late in 2025. The recovery in yields has restored some relative appeal to US fixed income, potentially encouraging foreign inflows seeking short term stability. In turn, this environment continues to underpin demand for the US dollar and supports the recent bounce in the DXY.

Risk Scenario: Data Disappointment

While markets are positioned for a constructive employment print, risks remain two sided. A sharp downside surprise in payrolls would likely force a reassessment of the Fed’s policy path. In such a scenario, expectations for rate cuts could resurface more quickly, placing renewed downward pressure on Treasury yields. That would likely weigh on the US dollar and reopen the door to fresh selling in the DXY after the data release.

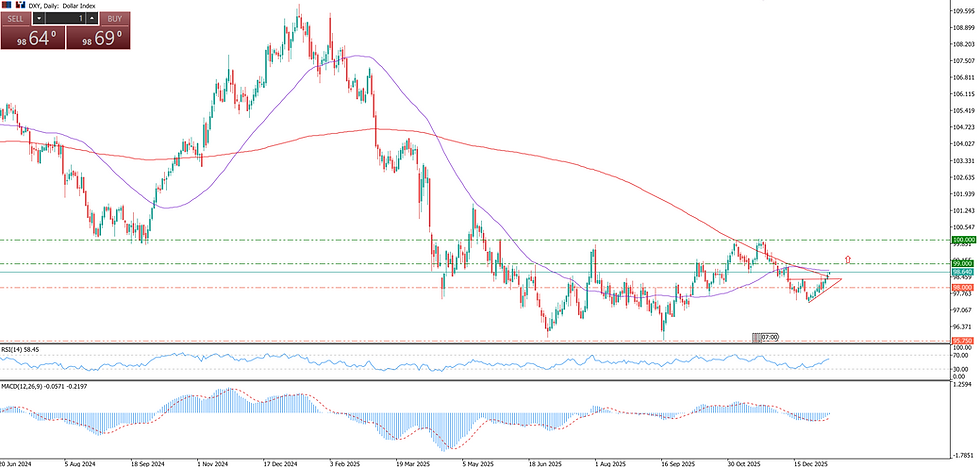

DXY Technical Outlook

From a technical perspective, the broader bearish trend is beginning to face pressure. Since late November 2025, the DXY has respected a downward trend structure, but the latest rebound is now challenging that setup in the short term.

Holding above the 50 and 200 period moving averages would be an important signal, as it could mark a transition toward a more dominant bullish bias. Such a shift would reinforce dollar strength against major peers, particularly the euro and the British pound.

Momentum indicators are supportive. The RSI remains above the neutral 50 level, indicating improving bullish momentum over the past two weeks. The MACD histogram continues to print above the zero line, confirming that short term momentum remains tilted to the upside. Further expansion in the histogram would strengthen the case for continuation.

Key Levels to Watch

100: Major psychological resistance. A sustained move toward this level would signal the potential start of a broader bullish phase.

99: Near term resistance aligned with the 50 and 200 period moving averages. A clean break above this zone would weaken the prior bearish structure.

98: Key support. A sustained move back below this level would revive bearish momentum and reassert the broader downtrend.

Bottom Line

The US dollar is regaining traction ahead of the NFP release, supported by stabilising yields and shifting Fed expectations. While momentum has improved, confirmation now hinges on labour market data. A solid report could allow the DXY recovery to extend, while a downside surprise would quickly challenge the current bullish setup.

Comments