GBPUSD Remains Range-Bound as Inflation and Growth Data Take Center Stage

- Alex

- Jan 12

- 3 min read

GBPUSD remains locked in a broad consolidation as markets brace for a pivotal week of macro data, with US CPI and UK GDP likely to dictate near-term direction. The fundamental backdrop continues to favor the dollar, with US growth momentum standing in sharp contrast to the UK’s sluggish outlook.

US GDP growth has climbed to a two-year high near 4.3%, while UK growth expectations remain close to stagnation around 0%. This divergence continues to underpin relative USD strength and limits upside follow-through in GBP for now.

US CPI is expected to stabilize near 2.7% following a mixed US labor market report. While headline NFP disappointed at +55k versus expectations of 66k, the unemployment rate surprised to the downside at 4.4%. This combination has reinforced Fed policy uncertainty rather than delivering a clear dovish signal, allowing the dollar index to remain supported within its broader range.

Haven Demand Supports USD Stability

Geopolitical risks remain an important overlay. Rising global tensions continue to support defensive positioning, reinforcing demand for haven assets. Gold and silver remain structurally bid, with silver targeting long-term triple-digit territory above 100 and gold maintaining its longer-term trajectory toward the 5000 zone.

In line with this backdrop, US equity indices have paused after their recent advances, while the DXY has remained resilient near the 99 handle. The 100.40 level remains the key threshold separating a renewed bullish phase from continued consolidation. A sustained move above this barrier would likely pressure major counterparts, including GBP and EUR.

GBP Faces Structural Headwinds

Sterling continues to struggle beneath key technical ceilings. Price action remains capped below 1.38, the level that separates long-term bullish continuation from extended consolidation, while 1.36 remains the more immediate resistance.

The fundamental picture offers little relief. The Bank of England’s dovish stance continues to weigh on GBP, with markets pricing further rate cuts in 2026 following the December 25 bps cut to 3.75%. This outlook is reinforced by weak growth momentum and easing inflation, now down to 3.2%.

These dynamics leave GBP vulnerable to downside pressure unless upcoming data meaningfully surprises, particularly through stronger UK GDP or softer US inflation.

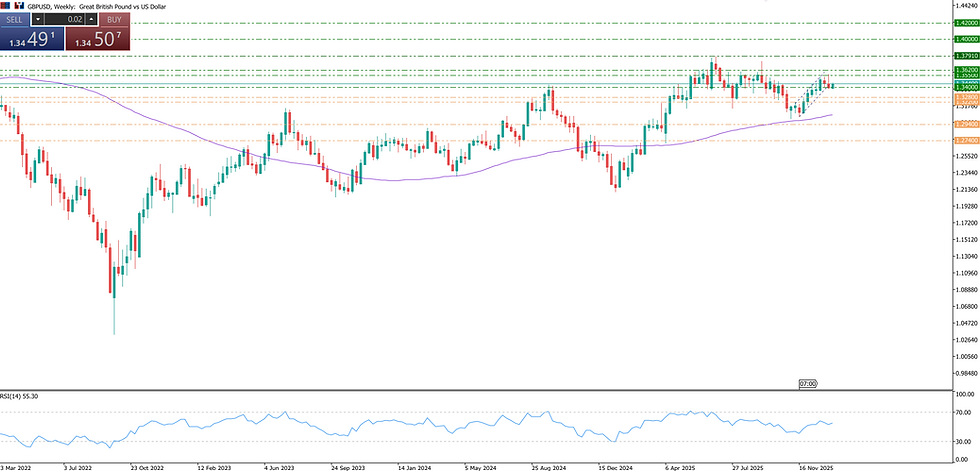

Technical Outlook: Weekly Time Frame

On the weekly chart, GBPUSD continues to respect the boundaries of a multi-year consolidation defined by rising highs from July 2023 through September 2025. This structure has established a major resistance zone near 1.38.

Despite the lack of a breakout, the medium-term bias remains cautiously constructive. Weekly RSI is holding above the 50 neutral level, suggesting neutral-to-bullish momentum. Price also remains supported above the 1.30 psychological level, the nine-month support zone, and the 89-period SMA.

A sustained hold above 1.36, followed by a clean break of 1.38, is required to confirm a longer-term bullish continuation, opening scope toward 1.40 and ultimately the 2021 high near 1.42.

Failure to reclaim 1.36 would increase the risk of a corrective pullback. Initial downside levels to monitor lie at 1.3280 and 1.3220, with 1.30 acting as a critical pivot. A decisive break below this zone would shift the broader structure lower, exposing 1.2940 and 1.2740.

Technical Outlook: Monthly Time Frame

From a monthly perspective, GBPUSD is trading beyond the upper bounds of the long-term consolidation that has defined price action since 2007, while still eyeing the 2021 peak near 1.42.

A sustained move below 1.30 would likely signal a deeper retracement toward 1.2940 and 1.2740, aligning with the upper boundary of the long-term range connecting lower highs over the past two decades.

Conversely, a confirmed break and hold above the 2025 high at 1.38 would reinforce a longer-term bullish extension toward 1.42. Such a scenario would likely coincide with EURUSD approaching its own 2021 highs near 1.22, alongside a broader dollar decline that could see the DXY drift toward its 2021 trough near 89.

For now, GBPUSD remains in wait-and-see mode, with upcoming US CPI and UK GDP releases expected to provide the next directional catalyst.

Comments